iowa capital gains tax 2021

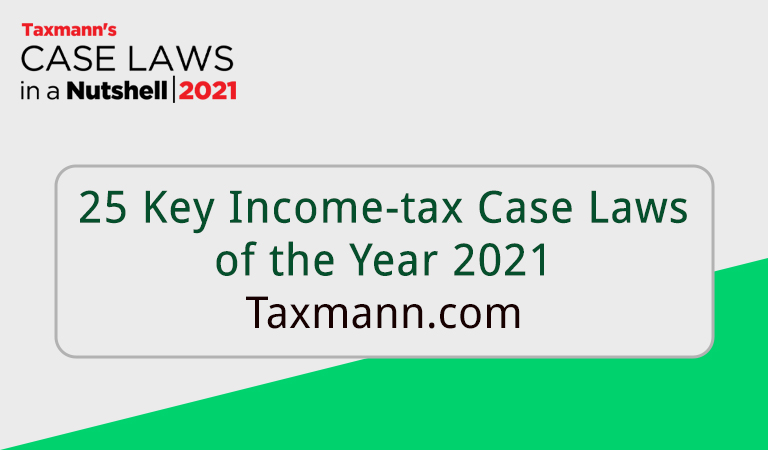

Taxes capital gains as income and the rate reaches 853. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual.

What Are The New Capital Gains Rates For 2022

What is the Iowa capital gains tax rate 2020 2021.

. Introduction to Capital Gain Flowcharts. Under tax reform passed 2018 and 2019in and modified. See Tax Case Study.

41-158b 07062021 Instructions for 2021 IA 100D Iowa Capital Gain Deduction Sale of Timber. The rate reaches 715 at maximum. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction.

Iowa is a somewhat different story. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if.

Starting with the 2021 tax year Iowa is repealing its state inheritance tax. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. You will be able to add more details like itemized deductions tax credits capital gains.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Unrelated losses are not to be included in the. This is a deduction of qualifying net capital gain realized in 2021.

Iowa is a somewhat different story. Starting in 2023 Iowa Code 422721. Get Access to the Largest Online Library of Legal Forms for Any State.

However the actual rates are lower because iowa has a unique deduction for federal income taxes from. Line 23 can be more than the net total reported on Schedule D. This means that different portions of your taxable income may be taxed at different rates.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. The Iowa capital gain deduction is subject to review by. 1 2025 with rates gradually decreasing over time.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to. Includes short and long-term Federal and.

The tables below show marginal tax rates. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Capital GAINS Tax.

Your average tax rate is 1198 and your marginal tax rate is 22. 2021 IA 100D Instructions page 2. To claim a deduction for capital gains from the qualifying sale of.

The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. Contact a Fidelity Advisor. Individual income tax exclusion for capital gains narrowed.

2 days ago Oct 12 2021 Des Moines Iowa. Capital Gain Loss Iowa Department Of Revenue 1 week ago 2021. Taxpayers who had capital gains in 2021 that were reported on the installment method for federal tax purposes and the entire gain was reported for Iowa in a prior year do not have to report.

What is the Iowa capital gains tax rate 2020 2021. Iowa Income Tax Calculator 2021. 2021 federal capital gains tax rates.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. This is scheduled to happen on Jan. Taxes capital gains as income.

Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Current Iowa law has complex rules governing the deductibility of certain capital gains.

When a landowner dies the basis is automatically reset. A copy of your federal Schedule D and. At the 22 income tax bracket the federal capital gain tax rate is 15.

Cattle Horses or Breeding Livestock complete the IA 100A. The Iowa income tax has nine tax brackets with a maximum marginal income tax of 853 as of 2022. Contact a Fidelity Advisor.

The Iowa capital gain deduction is subject to review by the Iowa Department of. Toll Free 8773731031 Fax 8777797427.

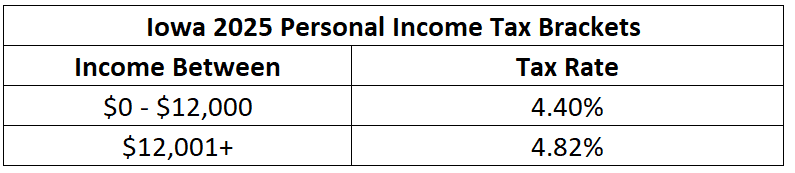

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg

Wealthy May Face Up To 61 Tax Rate On Inherited Wealth Under Biden Plan

Inheritance Tax Here S Who Pays And In Which States Bankrate

Avoiding Capital Gains Tax On Property In 2022 Here S How Vakilsearch Blog

25 Key Income Tax Case Laws Of The Year 2021 Taxmann Com

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Solved Can You Avoid Capital Gains Taxes On A Second Home

Wealthy May Face Up To 61 Tax Rate On Inherited Wealth Under Biden Plan

Solved Can You Avoid Capital Gains Taxes On A Second Home

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

State Income Tax Rates What They Are How They Work Nerdwallet

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Wealthy May Face Up To 61 Tax Rate On Inherited Wealth Under Biden Plan